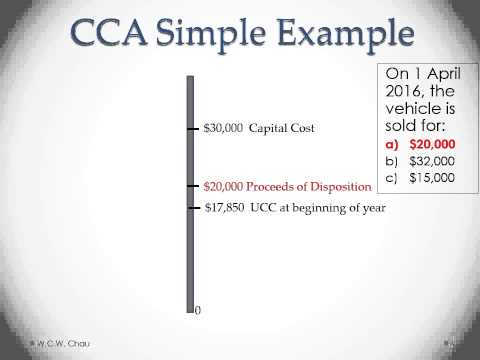

Hello, this is Waylon and I'll be talking about capital cost allowance or CCA. CCA is the tax version of depreciation for financial accounting purposes. You are allowed to claim depreciation expense on many of your capital assets for tax purposes. Instead, you claim a CCA deduction. We have a simple example here involving a company called Super Consulting, which in 2014 purchased its first and only vehicle for $30,000. We are assuming that Super Consulting's fiscal year-end is December 31st. Let's put that $30,000 capital cost into the Class 10 CCA balance for Super Consulting. Class 10 applies to motor vehicles under the CCA rules. In our example, the only asset in that Class 10 balance is the vehicle, which costs $30,000. So, our starting point is the $30,000 balance for Class 10. In the first year, 2014, we assume that Super Consulting will claim the maximum available CCA deduction. The deduction amount will be $4,500, which we arrived at by applying the 30 percent CCA rate applicable for a Class 10 asset. However, in the year that you acquire a new asset, there is something called the half-year rule, which only allows you to claim half of what you would usually be able to claim. That's how we arrived at the $4,500 deduction. We claim that $4,500 deduction for 2014, bringing down our Class 10 balance to $25,500. This remaining balance is called the UCC (undepreciated capital cost). Now, we're in the year 2015. At the beginning of that year, our UCC balance is $25,500. Let's also assume that Super Consulting will be claiming the maximum CCA deduction available for 2015. The CCA deduction for 2015 will be $7,650, which is calculated by multiplying the 30 percent rate by the UCC of $25,500. This brings down our UCC to $17,850. That's...

Award-winning PDF software

28 rate gain worksheet Form: What You Should Know

Note: The 2025 and 2025 regulations state that a qualifying change of use can be the conversion of tangible property from the qualified use of one qualified use to another, the replacement of tangible property with other goods or services that was previously owned by the taxpayer, or the replacement of tangible materials and equipment that were previously in the taxpayer's inventory. Calculating the 26.66% capital gains tax rate on sales of inventory 2021 Instructions for Schedule D — Adjust 28% Rate / 1250 Worksheet Menu Jul 1, 2025 — Form 4797 (part of the 2025 Form 4797) determines whether you are a REIT for the year and if so, the effective tax rate. There are 2 rules to use when determining if the qualified REIT income rate on line 9b is more than 26.66%. The first rule: The 26.66% is based on your entire adjusted basis, which doesn't necessarily increase for you if you sell or exchange assets. You use the whole basis when calculating the REIT income in Lacerate or if your adjusted basis equals more than the basis required to be reported in Schedule D (see line 1), or line 9. If you want to use the second rule: When the qualified REIT income rate on line 9b is 1250%, the entire adjusted basis, not your adjusted basis when selling or exchanging assets, is used. So, if you sell or exchange a share of stock, you will be able to use your entire adjusted basis and then add in the additional tax, and you will be taxed at 25%. If you sell or exchange an interest in a partnership, you use the entire adjusted basis, not the adjusted basis when selling or exchanging assets. You then add in the additional tax, and you will be taxed at the maximum rate of 39.6%. Example: When you sell a stock, and you are taxed 30%, you have to pay the capital gains tax of 10% of that amount. You can then use the result on line 5a of the Lacerate Worksheet to decide if you want to report the 28% rate and use the adjusted basis the previous year to determine if your adjusted basis is more than the 28%.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form instructions 1040 (Schedule D), steer clear of blunders along with furnish it in a timely manner:

How to complete any Form instructions 1040 (Schedule D) online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form instructions 1040 (Schedule D) by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form instructions 1040 (Schedule D) from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing 28 rate gain worksheet